We think “Niche” is the next big thing and here’s why.

Don Valentine once said “I like opportunities that are addressing markets so big that even the management team can’t get in its way.” Don founded Sequoia Capital and led investments in companies like Cisco, Oracle, and Apple. Simply put, he is one of the best all-time venture investors so when Don spoke, people listened. Don’s POV on market sizes and the importance of storytelling has informed much of the Silicon Valley “pitch” mindset of the last 3–4 decades, orienting founder <> investor behavior around grandiose pitches on “TAM (Total Addressable Market)” at the earliest stages. Given Don’s success, it’s hard to argue with the approach.

That said, the world is changing. Competition in tech is as intense as in any market out there. This wasn’t the case twenty years ago when barriers to entry were higher and competition was scarcer. Back then, tech startups were just a quirky “niche” in the larger economy. Today, they are the economy. As industries mature it’s only natural for competition to flow to where the returns are — and the returns in tech have been amazing for several decades (even after 2022’s pullback).

But the tech industry has become a victim of its own success, inviting immense competition. Gross margins remain high for software, but the cost of acquiring/retaining customers and the continuous R&D required to maintain parity with the market is taxing. While many VCs value a company based on multiples, the core underpinning of a company’s value when it hits public markets is its future cash flows. Given the continuous investments needed simply to keep pace with competitors, it is unclear whether some venture-backed companies will EVER be able to generate cash flow.

The core competencies required for success have changed as well. Chasing a large TAM with a great story isn’t enough. If you don’t have the mechanisms to create a sustainable advantage that generates long-term cash flows, you’ll be sitting atop a melting ice cube. Public markets have made this resoundingly clear in 2022, with the Nasdaq down more than 30% and much sharper declines across the highest-flying sectors that commanded top multiples. Many of the companies with high growth, large TAMs and great narratives around their business have since plummeted back to earth, some of which are worth less than the cash on their balance sheets. Many of these companies raised hundreds of millions (if not billions) to “win” their market, with the justification that the size of prize was worth the investment. Many are now struggling to find any path to profitability and sustainable earnings power.

Competition — the killer of profits

There is one sacred rule of business that is often not addressed — “Competition is bad for business.” Government agencies focused on anti-trust regulation are in place for a reason, since companies that dominate their categories and lack meaningful competition can have immense power over their consumers and extract outsized economic rents (as evidenced by companies like Alphabet, Microsoft, Amazon and Apple). I’m not sophisticated enough to opine on what level of competition is fair, but generally the less competition a business faces, the better its chances of generating earnings.

While most monopolies are formed via network effects, economies of scale, or state-granted permission, there is another often overlooked form of monopoly power that we see every day but rarely apply to the tech industry: the structural monopolies of niche markets. Bruce Greenwald wrote about this concept at length in his preeminent work, Competition Demystified, which highlights geographic proximity and market size as two major parameters that contribute to monopoly-like returns. These markets are often too small to lend themselves to multiple winners, so once a competitive advantage is set, the dominant firm can generate significant profits from that position.

If you’ve ever paid $16 for a beer at a concert or a baseball game, you’ve felt the power of geographic proximity. The same could be said for retail and local services in rural markets, where you’ll see players take outsized margins knowing that consumers have limited options. This was core to Walmart’s success and is a wonderful case study in Competition Demystified, where Greenwald highlights Walmart’s ability to crowd-out local competition, leveraging their corporate economies of scale as competitive advantage against their localized competitions. Walmart’s success centered around both geographic and market size constraints. But in the decades since Walmart established its dominance, new technologies made the geographic constraint less limiting, making TAM constraints one of the last bastions away from competition.

Small markets = less competition = more profits

Market size constraints are a limiting factor to growth, but they also limit competition. One of the best structural examples Greenwald gives is the chemicals industry, where specialty operators in small or declining markets earn returns on equity far higher than those in larger, growing markets. This is because small or declining markets can’t accommodate multiple players capable of driving long-term profits. Competitors exit the market, as the juice is not worth the squeeze.

This is often the same case in new markets too, where TAM is grossly undersized. Clayton Christensen discusses this at length in The Innovator’s Dilemma, noting the persistent failure of forecasting and posing that organizations should build for optionality and agility given the uncertainty of market sizes and adoption rates. We’ve also seen examples like Uber that were attacking markets that initially seemed small (i.e. the black car market, which only represented a few hundred million of gross margin in the entire US at the time), before morphing into something far larger.

Given all these uncertainties, a large market simply isn’t enough. It’s your positioning in the market that matters. Market share is one of the leading determinants of margin, so if you want to be a profitable company, it’s not about being in a high gross margin category like software, it’s about owning your market.

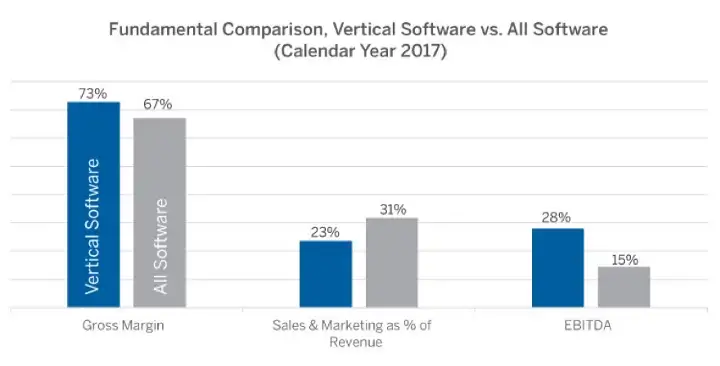

Once a company has dominated its market, it can use that foundation to expand their addressable market (or produce cash flow to return back to shareholders). We’ve seen Amazon do this as it expanded beyond books, simply using that initial market as a beachhead for future exploration into ecommerce. Similarly, we’ve seen conglomerates like Berkshire, Danaher, AB InBev and Nestle expand horizontally into other markets, leveraging cashflows from their initial core markets to fuel acquisitions and growth into other markets. We’ve even seen this in software as well with companies like Roper Technologies and Constellation Software, each of which focus on acquiring and operating vertical software businesses in “niche” markets. These vertical software businesses, generally spend far less on sales & marketing than their horizontal competitors, and produce nearly double the level of EBITDA.

The unifying trend behind all these business strategies is that they are able to 1) develop early competitive advantage in a market, 2) dominate the market share of that market, 3) produce profits and/or cashflow from that position and 4) choose where to expand from there. Given the law of large numbers, it’s far more efficient to capture a dominant market position in a smaller market than it is in a larger one with lots of competition, which is why we think niche markets represent an underestimated beachhead for great companies.

Niche markets — the next BIG thing

We’re already seeing examples of this in our portfolio with companies like Starday, a digital-first conglomerate of “niche” food brands. Starday uses data to identify niche food categories that are unaddressed and simulates data to determine how/why/where consumers will buy those products. Each of the brands it operates in a niche market where it can be 1) the market share leader within the first few years of launching and 2) is capable of generating long-term contribution margins greater than 50%. Each of these categories wouldn’t be exciting enough to attract venture capital on their own, but the aggregate mission of Starday is to launch 100 brands in the first 10 years to produce $1B of annual EBITDA. I can’t speak for other investors, but $1B of EBITDA is exciting enough to attract me.

Starday is just one example of our portfolio companies dominating “niche” markets that investors once thought to be TAM-constrained and we’re excited to see this thesis play out across Equal’s core sectors. As long-time investors in vertical software, we know that these niches can create beachheads to amazing businesses with significantly less resources required.

There are already plenty of challenges for founders to face. Don’t make taking on an army of competitors for the sake of justifying “TAM” another one of them, unless you know you’ll have the resources to win that war. With leaner times undoubtedly ahead, we expect an increasing focus on capital efficiency in the years to come and know that niches provide a pathway for founders to achieve growth AND efficiency, not just momentum amidst a flooded market of competitors that requires hundreds of millions in capital to simply exist. With capital getting tight in 2023, we think “niche” could very well be the next BIG thing.