No one would ever say that starting up a business is easy. Founders encounter the most crucial difficulties at the very start of their work, and startup equity allocation is one of them. Equal or close-to-equal splits of startup equity among co-founders are the most reasonable choice but you can allocate shares in a different way based on what value each of them brings to the project.

Since at the early stages, startups sometimes don’t even have enough revenue to pay salaries, or even yield quick profits ,one of the most common ways to inspire and support it’s key actors is a startup equity split

As your company expands, you are faced with many obstacles; allocating startup equity is simply one more that needs to be resolved.

As a young startup, equity is one of your most advantageous weapons. It stands for firm ownership and gives you something to provide investors in exchange for their financial assistance.

You must prepare carefully from the start and ensure that everything is covered by legally enforceable agreements if you want to maintain everyone’s happiness and maintain control of your organization.

Make sure to include any equity investment rounds in your company’s strategy if you expect to use them to raise money in the near future.

Make sure you account for yourself and any other business founders by adding up the percentages of equity you are willing to give to investors at each level.

Before diving into how startup’s equity is to be shared let us answer this question; who exactly gets startup equity??

When thinking about how to share allocation for a startup, the first question should be: how many shares should a startup issue? There are different opinions on this matter, but the average number of shares for a startup in tech is between 10 to 20 million.

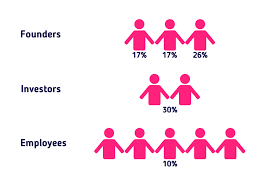

The second question is: who is going to be involved? Very often not only co-founders, but also other people like investors, key employees, or advisors take part in the startup equity split. There are several levels of the priority list. Co-founders go first, then a start-up should consider the interests of investors. If you have an advisor or a professor who contributes to the startup project, it’s reasonable to put this person before your first employee.

As a rule, the share percentage of independent startup advisors is around 5% (or no equity at all). Investors claim 20-30% of startup shares, while the founder and co-founder share percentage is over 60% in total. You may also leave some available pool (say 5%), but don’t forget to allocate 10% to employees. It makes sense to define roles within the company and assign job titles based on the most outstanding skills of co-founders. It’s also worth mentioning that while distributing the responsibilities, startuppers should think about their long-term expectations. It means that you need to figure out the future of your career, potential responsibilities & risks. Leave all uncertainties behind and open up to the team.

Let’s Move; Distributing Startup Equity

Startup equity is the percentage of a business’s value that stakeholders own. This generally refers to the worth of the shares that are distributed to owners, investors, and workers.

As a founder, you should ensure that the division of ownership in your company is done intelligently and effectively.

The simplest way to comprehend startup ownership, as corny as it may sound, is to imagine it as sharing a cake. There is only so much cake that can be cut and shared, and as your company prospers, the worth of each slice rises.

If you, the company’s owner, own 100% of it, you own the entire cake. Holding your company’s whole equity to yourself may seem desirable in principle, but in practice, you can only make as much money as it is valuable, and preserving 100% ownership will prevent your business from expanding. You must be prepared to give up some parts if you want your cake to increase in value overall.

Nevertheless, if you control 50% of the company and have a co-founder or team of staff with a wide range of abilities that may assist you in elevating its valuation from $50 million to $10 million, your investment is now valued at $5 million. Not bad at all.

The premise behind startup equity is that a business’s stakeholders should have precisely what that label implies, a stake in the business. Typically, this entails giving early contributors like investors and staff a fixed proportion of the business.

The date, level of contribution, level of dedication, and the startup’s valuation at the time of stock distribution all play a role in determining that percentage. Predictably, founders typically get the most initial ownership.

As a result of their investments being substantially bigger in relation to the startup’s initial valuation, the company’s first investors also obtain more equity than those who join later.

Additionally, workers who contribute to the business’s early success sometimes receive higher ownership percentages than those who are hired later.

The stages of finance are also closely related to equity distribution. Your financial situation inevitably changes as fundraising rounds advance, and almost always, how you allocate stock changes along with them.

The allocation of startup stock varies depending on a number of variables, such as timeframe, operating model, industry, CEO choices, and the number of stakeholders. There isn’t a concrete “one way this can happen” model for the procedure.

The equity distribution of a normal startup is still characterized by specific trends and largely constant numbers; be aware of them and allocate your startup equity accordingly.

Additionally, keep in mind that when a business grows, startup equity might change dramatically. And understanding the worth of your personal equity is crucial for anyone working for a developing firm in any capacity.

Investors value fair allocation of shares because it reveals to them a lot about the team’s cohesiveness. If a startup is not looking for investments but soon is going to be bought by another company, share allocation will be a task for the new owner. And in the case you have already handled this process among co-founders and began working with investors, you can get complete legal support and tech staffing assistance at Mountain Hub.

Also read, What you need to know about Startup Equity