Nearly 1,500 investors have been involved in at least one deal in Africa in the past couple of years… and that’s excluding angels! All of them are contributing to the growth of the ecosystem, but some are just taking things to a whole different level. This week we’re having a closer look at the investors who in the past two years (2021-2022) have signed at least one cheque a month on average*.

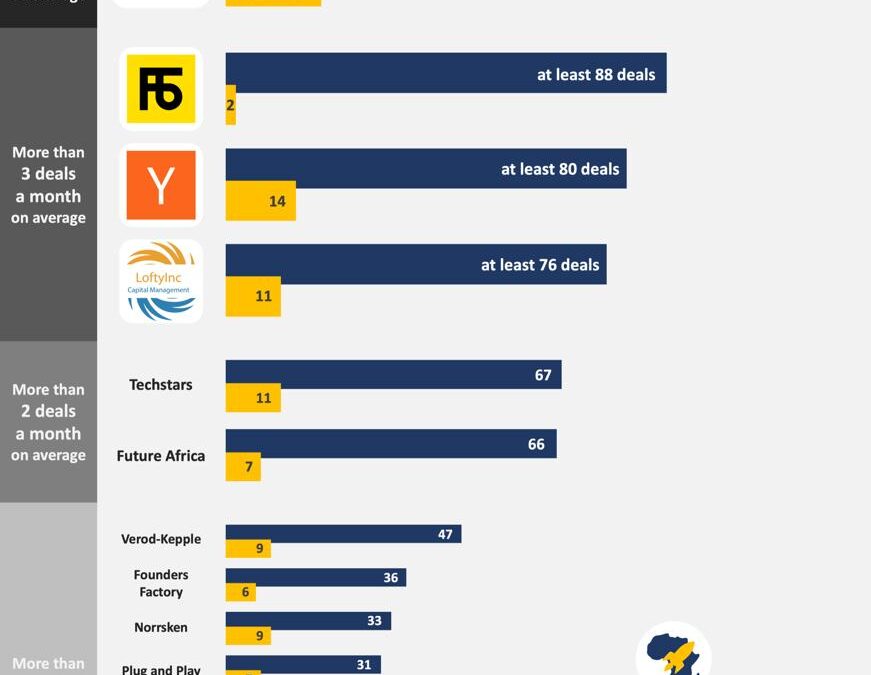

Launch Africa is the first name that comes to mind. They were the most active investor in terms of deal count in 2021, and repeated the feat in 2022. They have been signing more than a deal a week on average, have the widest geographical spread, and got involved in 12% of all equity deals between $100k and $10m that happened on the continent in the past couple of years.

They are followed by Flat6Labs who’s the only one of this very active group to focus exclusively on one region (for now?): Northern Africa (with 2/3 in Egypt and 1/3 in Tunisia). All the others have made investments in at least three different African regions during the period. The global accelerator-cum-investor Y Combinator continued to grow its presence in Africa in 2021-2022; 2/3 of its 2022 investments were focused on Nigeria (vs. 38% in 2021). LoftyInc also made more than three $100k+ investments a month on average during the period, almost half of which were in Nigeria. Next come another accelerator/investor – Techstars – and Future Africa; for both, every other $100k+ deal was also in Nigeria.

Eight more investors have participated in at least one $100k+ deal a month in Africa in 2021-2022: Kepple Africa Ventures (now Verod-Kepple Africa Ventures), Founders Factory, Norrsken, Plug and Play, Ventures Platform, Musha Ventures, 4DX Ventures and 500 Global. Quite a few of the investors on the list are linked to global programmes with an acceleration component, with various level of localisation of their offering to the continent.

Where did these most active investors invest? As we mentioned above, besides Flat6Labs, all have been active in at least three of Africa’s five regions. Most of them (8/14) actually have made at least one $100k+ investment in four regions. Launch Africa, YC, LoftyInc and Plug and Play have invested in all five. Central Africa was the region most likely to be overlooked though, with only 5 out of 14 investors getting involved in a deal there. How much did they venture beyond the Big Four? If we compare to the overall percentage of deals that happened outside the Big Four in 2021-2022 (25%), the majority of most active investors (8/14) did ‘worse’ and focused more of their investments on the usual suspects. Norrsken is the investor that invested the most in ‘the rest of Africa’, with 45% of its deals there.

And how well did they do on the gender front? The majority (9/15) did worse than the overall average in terms of investing in female-led start-ups (14% of deals overall in 2021-2022); Techstars is the one that performed the best (21%) while two investors on the list – who we won’t name and shame – didn’t back a single start-up with a female CEO during the period. When it comes to female-founded start-ups (where the founder is either a woman or a founding team including at least one woman), half did ‘better’ and half ‘worse’ than the overall average (27% of all deals involving a female-founded start-up). The percentage goes as high as 40% for Techstars, and 500 Global.

* While we did not formally include the Google for Startups Black Founders Fund Africa on the list as they provide ‘non-dilutive capital’, their contribution (113 grants to 12 markets) deserves to be mentioned.